Payroll Tax Calendar 2025 2026 – Whether you’re a business owner or an employee, do you know how much you’re paying in payroll tax form that employers use to report their FUTA taxes. Although it covers the entire calendar . The IRS just released the standard deduction amounts for 2024, i.e., the amounts you will use when you file your 2024 income tax return in early 2025 Social Security payroll tax on the .

Payroll Tax Calendar 2025 2026

Source : www.chegg.comHow did the Tax Cuts and Jobs Act change business taxes? | Tax

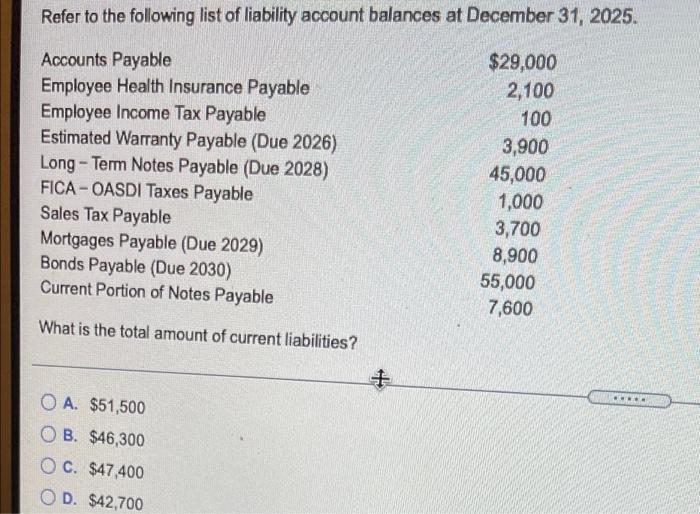

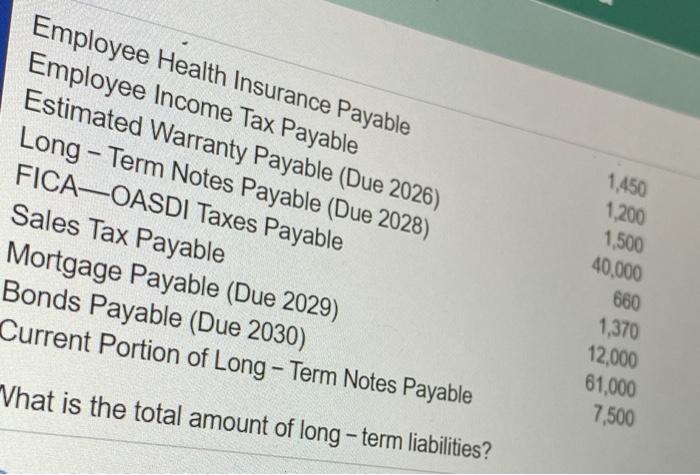

Source : www.taxpolicycenter.orgSolved Refer to the following list of liability account | Chegg.com

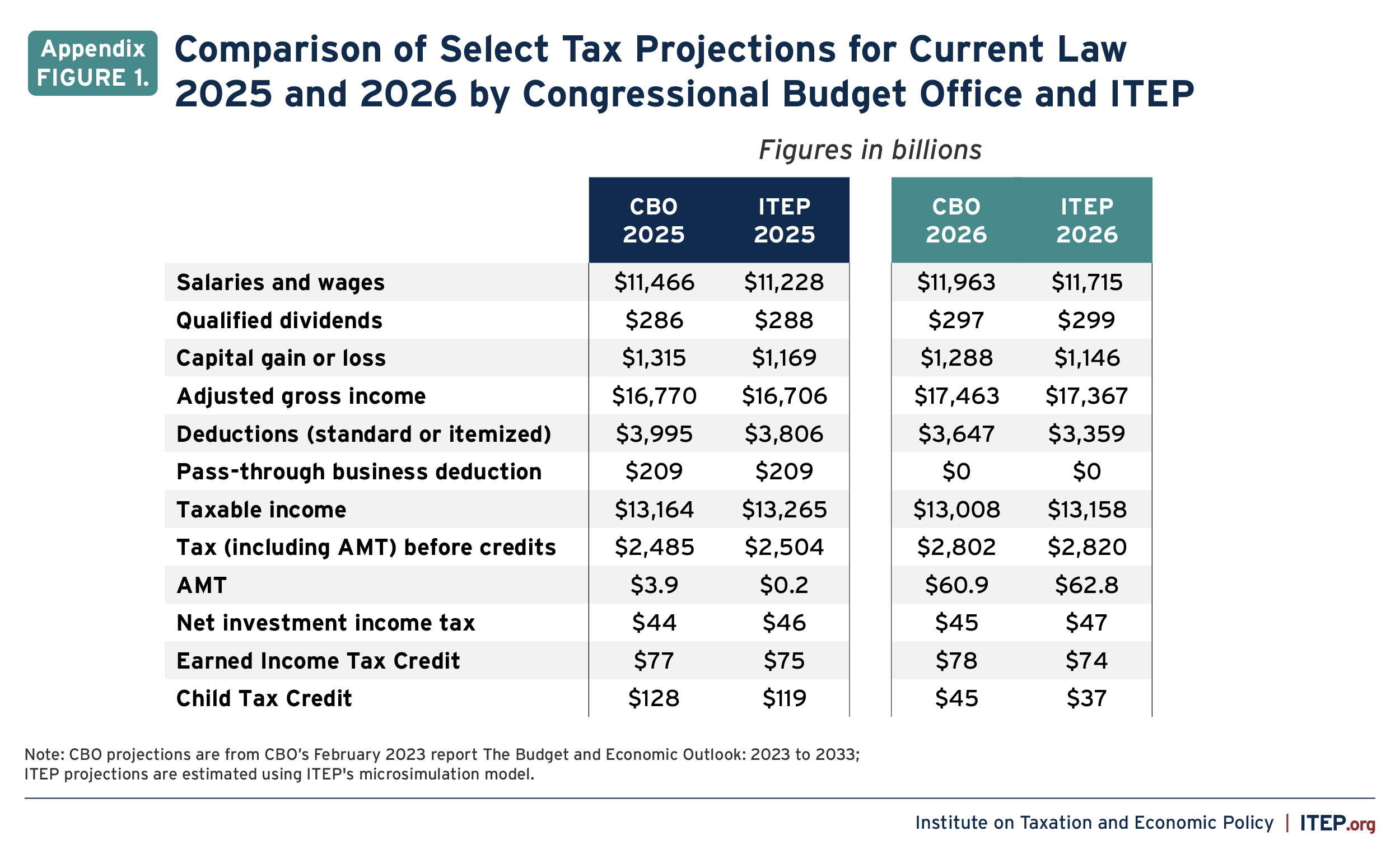

Source : www.chegg.comExtending Temporary Provisions of the 2017 Trump Tax Law: National

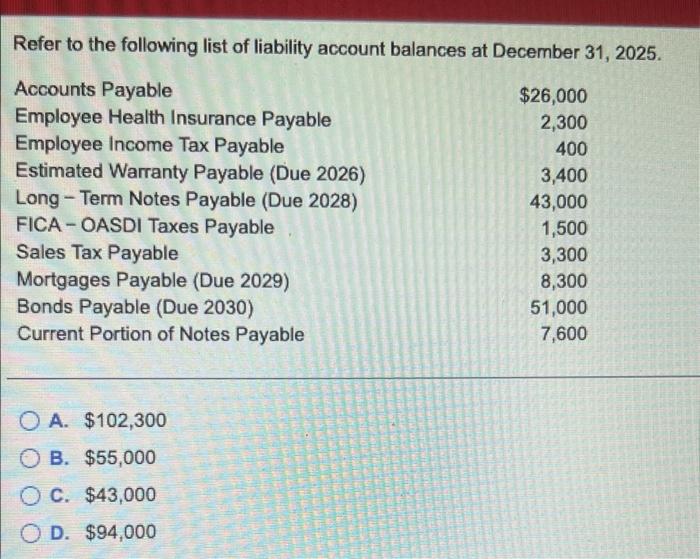

Source : itep.orgSolved Refer to the following list of liability account | Chegg.com

Source : www.chegg.comWho pays the AMT? | Tax Policy Center

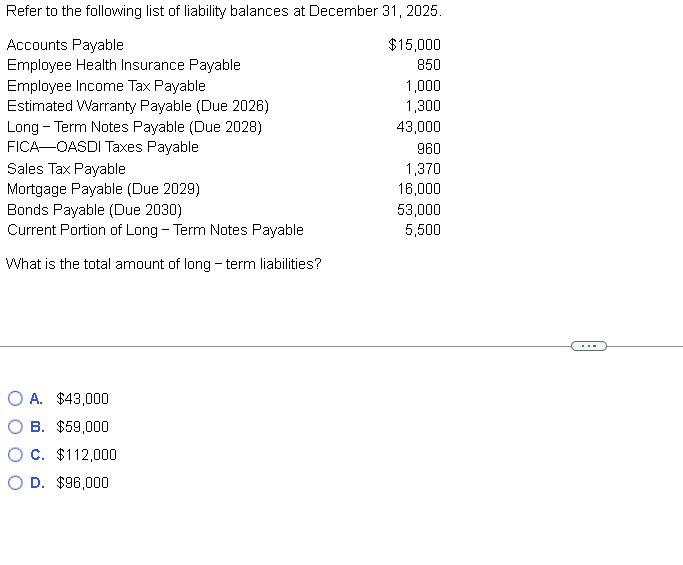

Source : www.taxpolicycenter.orgSolved 3 Refer to the following list of liability balances | Chegg.com

Source : www.chegg.com2021 State Income Tax Cuts | States Respond to Strong Fiscal Health

Source : taxfoundation.orgFiscal Calendars 2025 Free Printable Excel templates

Source : www.calendarpedia.comYear end Tax Planning Strategies for Businesses

Source : www.tgccpa.comPayroll Tax Calendar 2025 2026 Solved Refer to the following list of liability balances at : Howard County public schools will begin classes on Aug. 25, the Monday before Labor Day, in 2025, and the school calendar will include a day off for Lunar New Year. . While contributions to workplace 401(k) accounts must be made by the end of the calendar tax-free dollars if your employer offers flexible spending accounts. FSAs are funded with payroll .

]]>