Payroll Tax Calendar 2025 2026 – Whether you’re a business owner or an employee, do you know how much you’re paying in payroll tax form that employers use to report their FUTA taxes. Although it covers the entire calendar . Voters in November will decide on initiatives to repeal the capital gains tax and the cap-and-invest program and to change the long-term care insurance payroll tax. .

Payroll Tax Calendar 2025 2026

Source : www.chegg.comHow did the Tax Cuts and Jobs Act change business taxes? | Tax

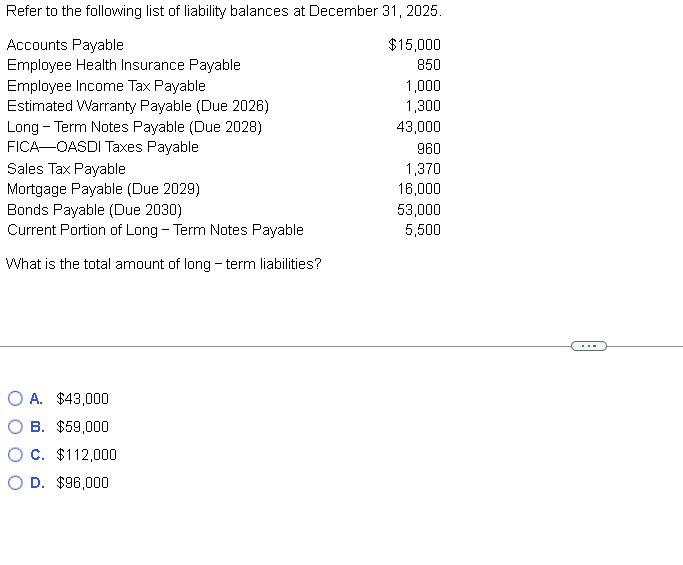

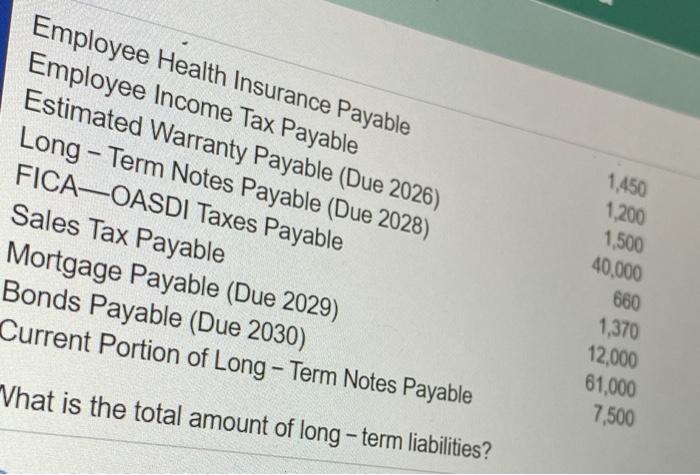

Source : www.taxpolicycenter.orgSolved Refer to the following list of liability account | Chegg.com

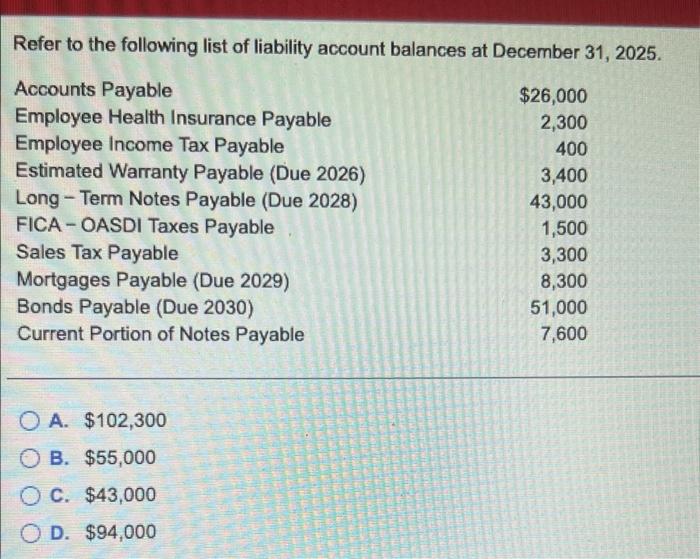

Source : www.chegg.comExtending Temporary Provisions of the 2017 Trump Tax Law: National

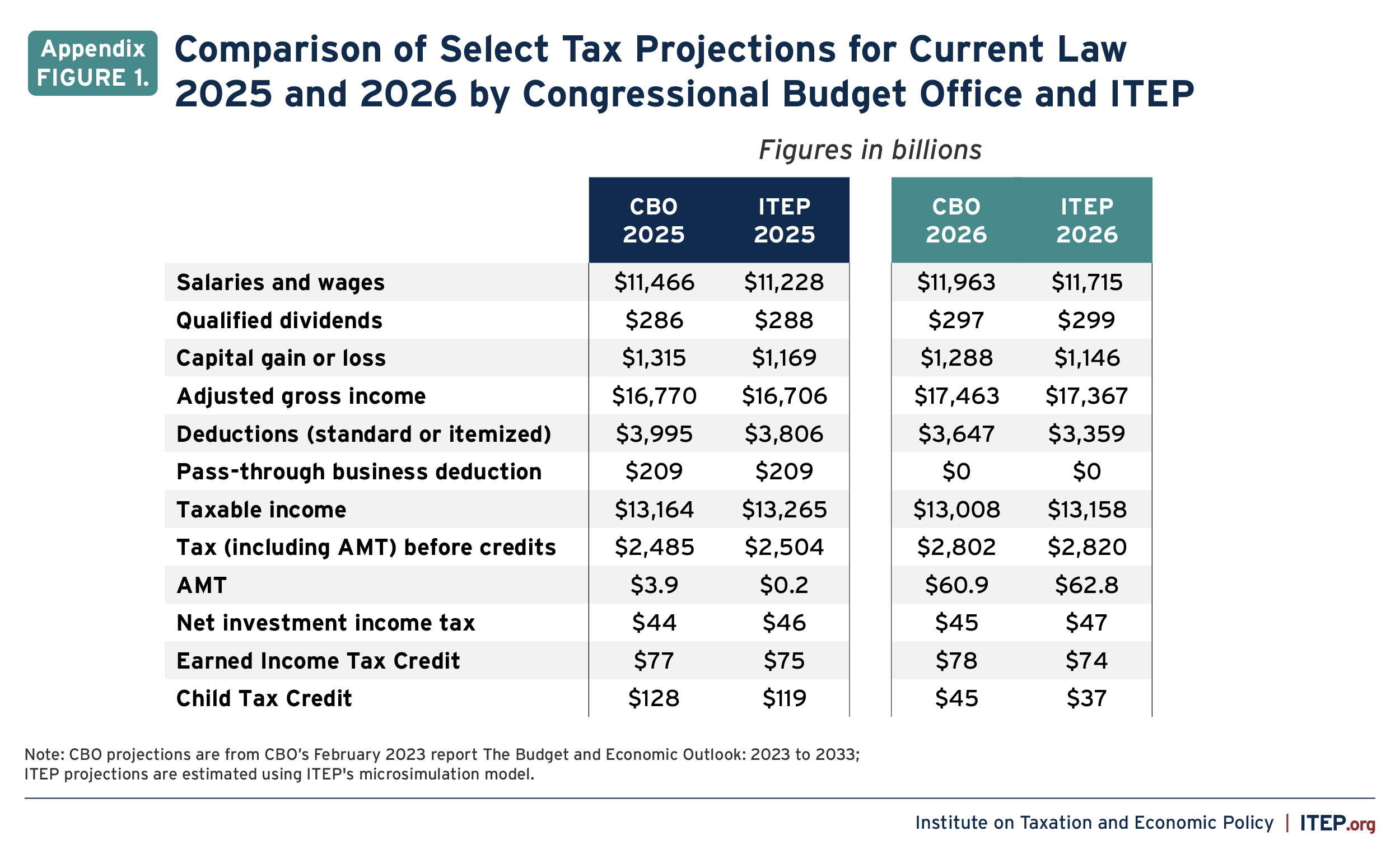

Source : itep.orgSolved Refer to the following list of liability account | Chegg.com

Source : www.chegg.comWho pays the AMT? | Tax Policy Center

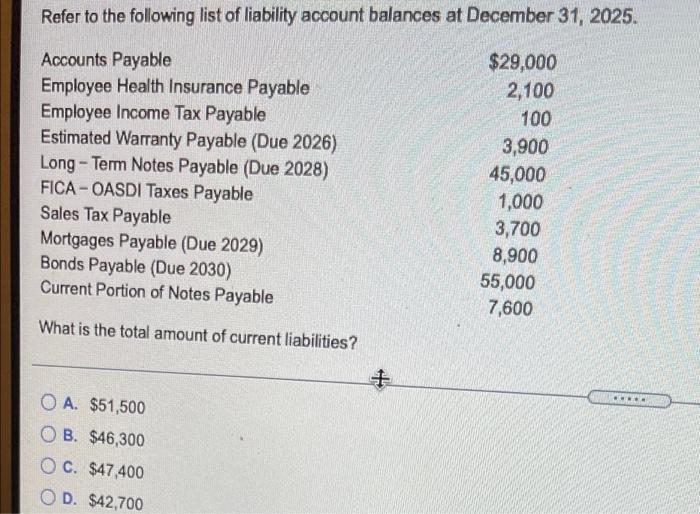

Source : www.taxpolicycenter.orgSolved 3 Refer to the following list of liability balances | Chegg.com

Source : www.chegg.com2021 State Income Tax Cuts | States Respond to Strong Fiscal Health

Source : taxfoundation.orgFiscal Calendars 2025 Free Printable Excel templates

Source : www.calendarpedia.comYear end Tax Planning Strategies for Businesses

Source : www.tgccpa.comPayroll Tax Calendar 2025 2026 Solved Refer to the following list of liability balances at : So, how is payroll tax calculated? Well, it depends on the tax, which makes it extra tricky for employers who run payroll manually. Here’s the good news: You don’t have to do payroll manually. . When building your payment calendar, you must also consider quarterly tax dates, holidays and annual tax filings. Did You Know? When deciding how frequently to run payroll, consider that .

]]>